Positive signs for Australian Cotton ahead of World Cotton Day

There are some positive signs for the 2024 Australian cotton crop with global demand increasing while major competitors are facing crop shortfalls due to seasonal conditions.

Ahead of World Cotton Day tomorrow, October 7, 2023, cotton merchants and shippers are reporting a higher level of engagement with buyers from multiple countries while emerging markets are stepping up their orders.

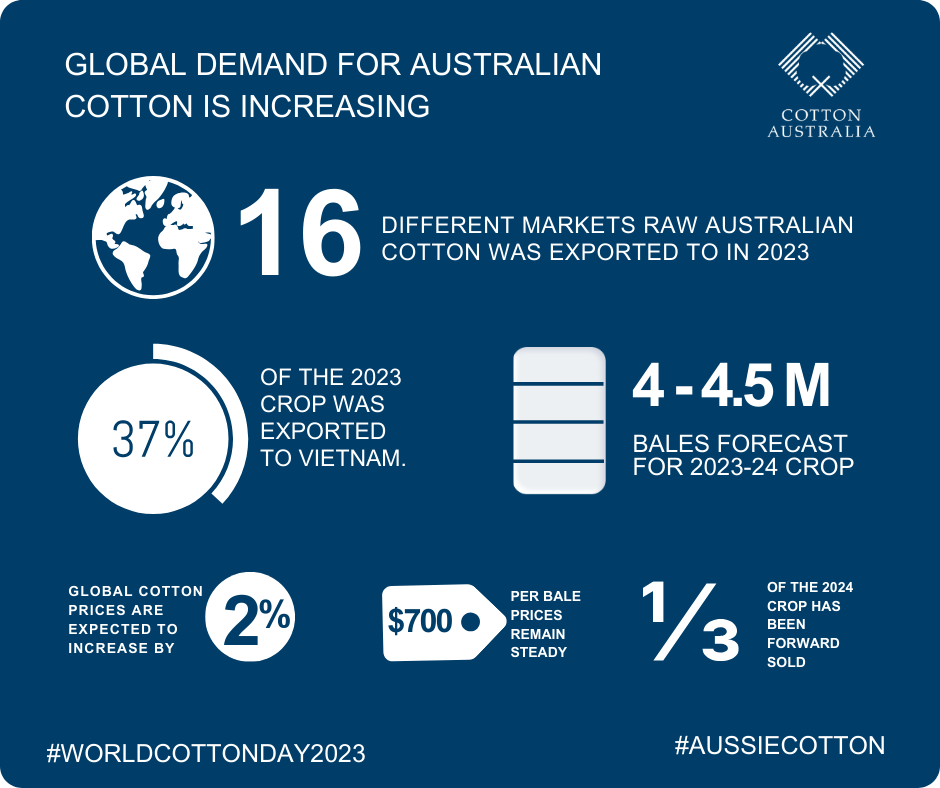

Raw Australian cotton was exported to 16 different markets in 2023 with Vietnam, a country targeted by Australian cotton merchants under the federal government’s Agricultural Trade and Market Access Cooperation (ATMAC) program, now taking close to 37% of our cotton.

The ATMAC program has also allowed stronger engagement with Indonesia and Malaysia with the countries now taking more than 20% of our total cotton exports combined. Other highlights include Turkey, Bangladesh and Thailand, importing close to 15% of our total export offering.

Cotton Australia CEO Adam Kay said the trade figures were positive signs. “Our farmers have virtually sold-out of the 2023 crop to merchants and indications are we have forward sold about a third of our 2024 crop with prices of $700 per bale remaining steady.”

Mr Kay said the industry was also in talks with India to double the Free Trade Agreement’s 50,000 tonnes of tariff free cotton.

Head of Cotton for ADM Trading Arthur Spellson said there is still some caution about demand from China with no formal change in the trade relationship.

“We know Australian cotton is being shipped into the country, but we don’t know how much is being cleared by customs for Chinese mills. We continue to work with buyers from all over the world and our merchants have done an excellent job marketing our cotton to new and emerging markets.”

Mr Kay said with Australia again entering an El Nino there are mixed expectations for the 2024 crop. “Growers with irrigated cotton are already planning their water budgets to ensure good soil profiles for their crops while dryland growers are weighing up their options and hopeful of rain to provide extra incentive to plant.”

Cotton industry forecasts for the 2023-24 crop range from 4 to 4.5 million bales with ABARES latest outlook for natural fibres forecasting the gross value of cotton production to fall to $3.2 billion, down 8% from the estimated $3.5 billion in 2022–23. Global cotton prices are expected to increase by 2% in 2023–24, driven by expected higher consumption and lower global production.

Mr Kay said despite macroeconomic factors dampening demand for cotton overall, farmers have some cause for optimism. “Our sustainability efforts are making a major impact and overseas buyers want our cotton because of its reputation for quality, colour and strength.

“The efforts of our Cotton to Market team are also being recognised with more brands demanding our cotton for their consumer items because of our environmental outcomes and our strategic roadmap which is focussed on meeting global sustainability target areas.”

A scan of the global cotton markets suggests Brazil, one of our key competitors, has had a good season and has been exporting a substantial amount to China, while the US crop is down by around 4% with lower production also reported from India and China.